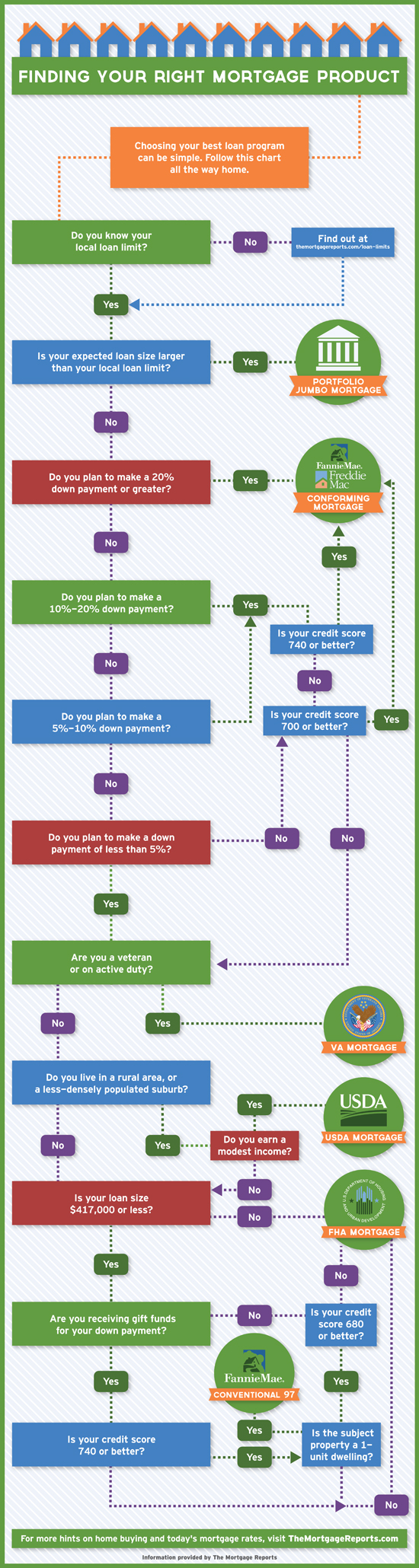

According to the National Association of REALTORS® Profile of Home Buyers and Sellers 2012, 73% of U.S. home buyers made a downpayment of 20% or less. Thankfully, there are still options out there for those of us who are unable to put down 20% cash on the purchase of a home. Among those options are the following:

Conventional Loan

*Options available under 20% down

*Private Mortgage Insurance (PMI) removed when a home’s LTV (loan-to-value) ratio is 80%

FHA

*Requires 3.5% down

*Higher cost to insure the loan with Private Mortgage Insurance (PMI)

*PMI remains for the life of the “active” loan

Fannie Mae Conventional 97%

*Only requires 3% down

*Down payment of 3% can come from own cash or gift funds entirely

*Loan size must not exceed $417,000

VA Loan

*Available exclusively to qualified military personnel

*No down payment required

*No Private Mortgage Insurance (PMI) required

USDA Loan

*No down payment required

*Home must be located within certain USDA specified areas, typically outside of city centers in more rural areas

*Buyer must meet certain income requirements

*USDA charges buyer a very small, insurance-like annual fee

If you are interested in learning more about any of these options, I have some great local mortgage professionals that would be happy to speak with you!

As always, please let me know if you have any questions…I am happy to assist in any way.

Tara Moore, REALTOR

taramoore@remax.net

407-765-3700

leave a comment