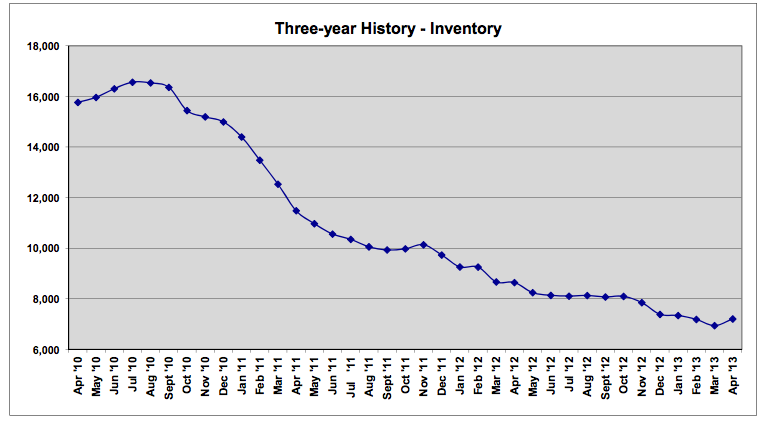

The current real estate market can be challenging for home buyers, as historically low inventory is causing bidding wars and above list price offers. Financed buyers are also still finding themselves beat out by cash investors. Below is a chart of the home inventory in Orlando over the last three years. As you can see, currently there are simply not enough homes on the market to meet the home buyer demand.

Is this an impossible time to purchase a home? NO. It just becomes increasingly important to make your offer as strong and competitive as possible…and this doesn’t just mean the highest price. Check back next week for a list of the most important points when submitting an offer on a home.

Tara Moore, REALTOR

taramoore@remax.net

407-765-3700

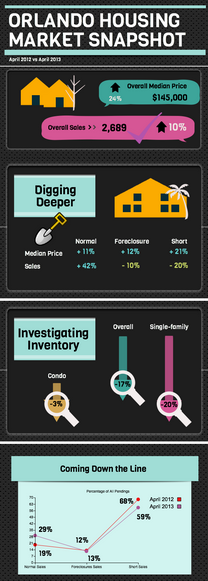

SOME ADDITIONAL KEY POINTS FROM THE ORLANDO HOUSING MARKET SNAPSHOT:

*Orlando home sales (all home types combined) in April 2013 were up 10.39 percent when compared to April of 2012 and down 0.77 percent when compared to March 2013.

*Of the 2,689 sales in April, 1,566 normal sales accounted for 58.24 percent of all sales, while 553 bank-owned and 570 short sales respectively made up 20.57 percent and 21.20 percent.

*The number of normal sales in April increased by 41.72 percent compared to April 2012, while short-sales decreased 20.17 percent and foreclosures decreased by 10.37 percent.

*The median price of all existing homes combined sold in April 2013 — $145,000 — is a 23.93 percent increase from the $117,000 median price recorded in April 2012.

*There are currently 7,202 homes available for purchase through the MLS. The April 2013 overall inventory level is 16.66 percent lower than it was in April 2012.

*Homes of all types spent an average of 76 days on the market before coming under contract in March 2013, and the average home sold for 95.96 percent of its listing price.

leave a comment