I have heard that a few times recently from prospective buyers clear disbelief that the payment for their dream house will be much less than they expected and/or way less than their current rent payments.

I have heard that a few times recently from prospective buyers clear disbelief that the payment for their dream house will be much less than they expected and/or way less than their current rent payments.

Today’s extremely low interest rates coupled with many flexible loan options create great options for most buyers. While shopping for a home in today’s market, it becomes less important what the purchase prices is.

For many, the most important question is…

“Can we afford the monthly payment?”

In many cases lately, that is where I have experienced the “shock and awe” effect mentioned above! Just remember…unless you are paying CASH for a house, you do not live in the purchase price, you LIVE in the payment.

So…what exactly is in a mortgage payment?

PRINCIPAL – this is the amount of your payment that goes towards decreasing the total loan amount. In most loans, this amount gets larger with each payment made…while the amount paid in interest gets smaller. This process is called loan amortization and is a good thing…it helps you build equity in your home.

INTEREST – this is your “cost” for the money borrowed. As mentioned above, the amount of interest paid decreases with each payment made as more money goes towards paying down the total loan amount. This is the area where having these historically low interest rates cause people to GAWK at the low total amount of their potential house payment. Just look at it this way…

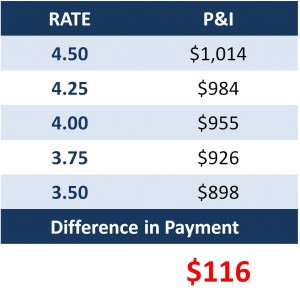

In this example, I have used a sale price of $200,000. Just ONE INTEREST POINT can decrease or increase your monthly payment by $116! This is why I am NOT JOKING when I talk about the importance of making your home purchase during this period of historically low interest rates. I cannot guarantee just how long they will stay this low…but we all know it won’t be forever! Once you lock in your low interest rate with a 30-year or 15-year FIXED mortgage…you are guaranteed that rate for the life of the loan.

PRIVATE MORTGAGE INSURANCE or PMI

Many of today’s great loan programs offer options for 0%-3.5% down payment, such as the very-popular FHA loan. In these instances where a buyer puts down less than 20% of the total selling price, lenders may required the buyer to have an insurance on the mortgage called Private Mortgage Insurance or PMI. This is a cost incurred in order to protect the lender in the event the loan defaults and the loan is foreclosed.

Depending on the lender, the annual cost of PMI can be between .19 percent and 1 percent of the total loan value. PMI can be paid up front but most buyers prefer that it be included in their mortgage payment. The cost can vary based on several factors that include: loan amount, loan-to-value ratio, occupancy (primary home, second home, investment property), documentation provided at loan origination, and most of all, your credit score.

Once an owner has built 20% equity in a home (whether through paying down the loan principal or appreciating home values), the PMI is no longer required and can be cancelled, therefore reducing your total overall mortgage payment at that time. In order to do so, you will most likely need to have a new appraisal done on the property to prove to the lender that you do, in fact, have 20% equity in the home.

PROPERTY TAXES

You will pay a portion of the annual property taxes on the home each month as a part of your payment. This amount will go into a separate escrow account which is managed by the lender or mortgage servicer. At the time property taxes are due, the lender or mortgage servicer will automatically pay them out of this escrow account in one lump sum. If there has been a change in total property taxes (increase or decrease), you will either be credited or charged for the difference at that time. When we look at properties, I will give you a detailed snapshot of the total estimated taxes on each property. That amount, divided by twelve, will tell us the monthly amount that will be added to the mortgage payment for taxes.

HOMEOWNER’S INSURANCE

The mortgage lender will also require homeowner’s insurance on the property. Something to be aware of: most standard policies include the typical coverages and wind/hurricane damage but FLOOD coverage is always an additional option. Flood insurance is not automatically included in the homeowner’s insurance policy – it must be requested and paid for separately. Homeowner’s insurance will either be billed in an annual or semi-annual term, but similar to the property taxes, it will be paid as part of the monthly payment and held in an escrow account. The lender or mortgage servicer will then pay the insurance payments when they are due.

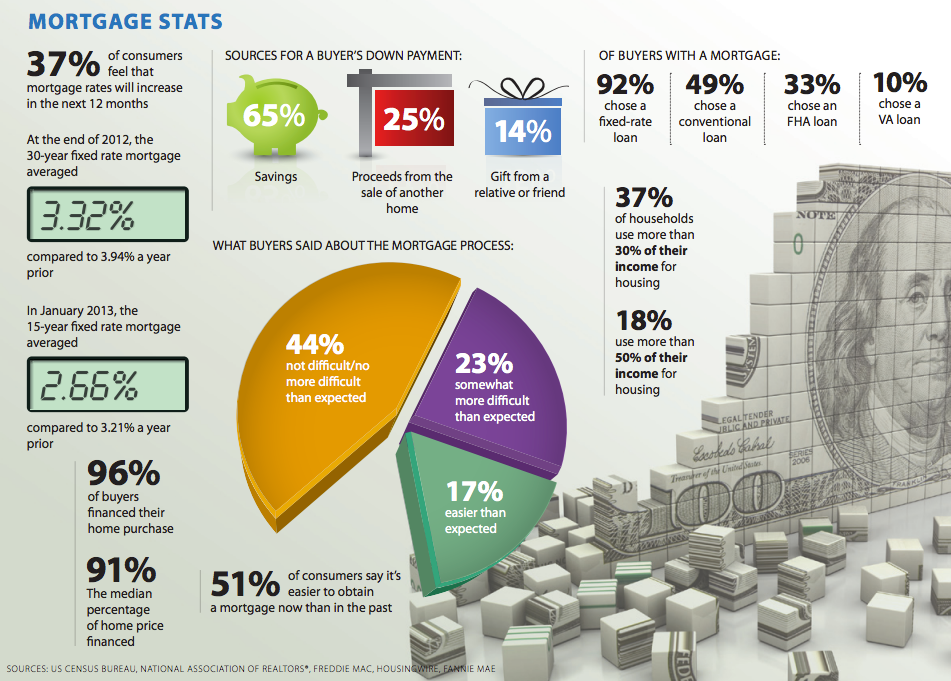

Take a peek at these MORTGAGE STATS…if you have any questions, please let me know!

Are you curious what YOU can afford? Let me know if I can help you figure it out…hopefully before home prices and interest rates increase any higher!

leave a comment